Breathing Fire into the Future: Unveiling the Rise of Digital Dragons in the Energy and Utilities Sector

You may not have heard, but the digital dragons are rising. What are they? And will they have an impact on the energy and utilities sector?

When we surfed the internet for extra information, we came across various definitions and sections such as the one below from Gartner:

“Digital dragons are companies that are embracing digital disruption and using it to enter, take over and dominate markets they often didn’t even play in before.”

In recent years, significant changes have occurred in the utilities market, particularly regarding the market participants involved. Upon closer examination, it becomes clear that numerous suppliers have ceased operations since 2016, with a further 31 experiencing such issues since the start of 2021.

These challenges can be attributed to the sharp increase in wholesale gas prices. Among the affected companies, Bulb Energy, which had a customer base of 1.7 million, stands out as the most significant case. Eventually, Octopus Energy (Kraken’s parent company) assumed control of Bulb Energy and its customers.

Furthermore, there is likely to be an upcoming challenge as industry experts and analysts suggest a significant likelihood of prominent players like Alibaba, Amazon, Tencent and Alphabet (Google) venturing into the energy market.

Source: Gartner, How to Deal With Digital Dragons When They Emerge in the Utility Sector.

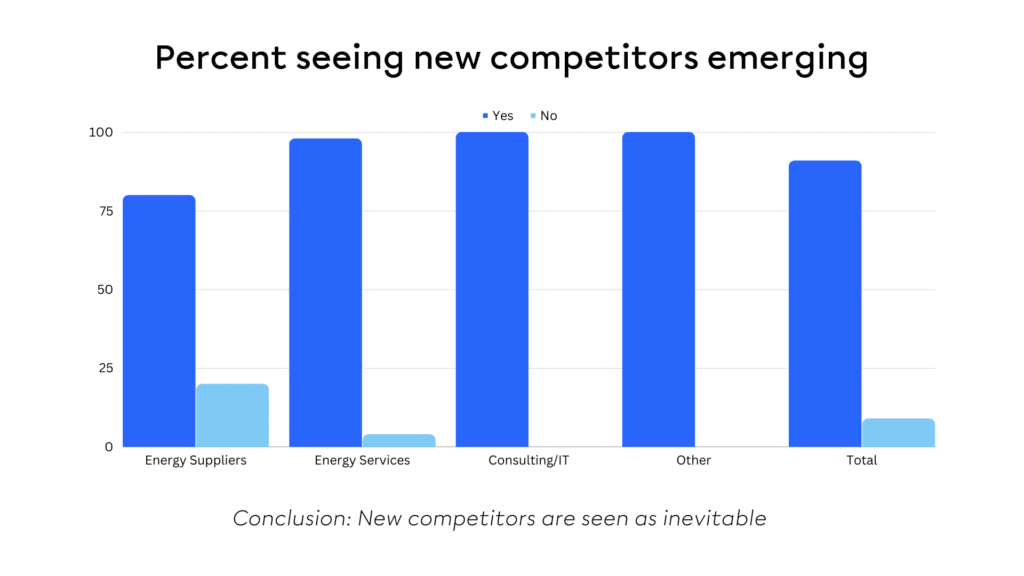

The above statement caught our eye, and we were therefore curious to know what esteemed experts from the energy and utilities community think about this view. In the survey we conducted to get a better view of the future of energy in the UK, we found that 80% of the experts surveyed think there will be new entrants providing a competitive threat.

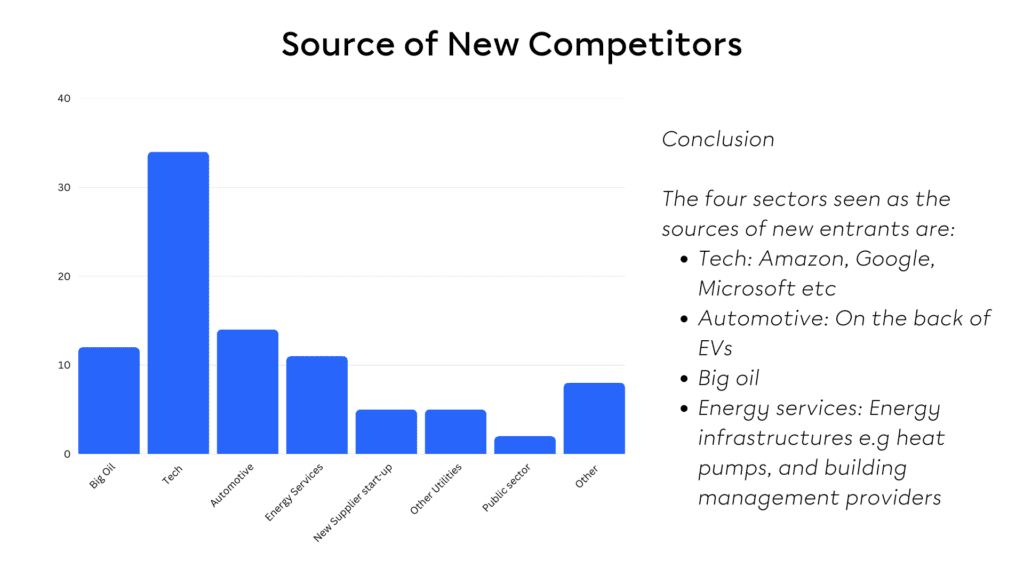

And when we zoomed in on this, we were surprised to find that 35% of them are convinced it will be tech companies such as Amazon, Microsoft, and Alphabet (Google).

Most of us expect these digital dragons to enter the market eventually! But the question is, what changes are they going to bring to the table and how can existing energy and utility companies deal with this?

First of all, we are convinced that when they enter the market, it is going to bring a lot of benefits to the end consumer and a lot of challenges for the existing suppliers.

Digital dragons like Alibaba, Amazon, Tencent and Alphabet (Google) could leverage their existing infrastructure and customer relationships to enter the retail energy market. When they do so, they might offer:

These are matters that suppliers should keep in the back of their minds and already explore options to quickly anticipate for when these dragons announce their market entry.

As most of these digital dragons already offer smart home solutions, they can easily include offerings for energy solutions, such as smart thermostats, energy monitoring devices, and home automation systems.

By integrating their platforms with utility services, they could enable customers to better manage their energy consumption and optimize efficiency.

An excellent illustration of this phenomenon can be observed in the collaboration between British Gas and Hive, in conjunction with Amazon Alexa and Google Assistant. This alliance has generated a pervasive impact on energy efficiency by leveraging voice commands, the Internet of Things, and mobile applications, leading to the expansion of interconnected services. This is one of the recommendations Gartner describes in the ‘fly the dragon strategy.’

Source: Gartner, How to Deal with Digital Dragons When They Emerge in the Utility Sector.

Companies like Alibaba, Amazon, Tencent and Alphabet (Google) have expertise in data analytics and technology. They could explore opportunities in energy storage solutions, such as batteries, and develop advanced grid technologies for grid optimisation, demand response, and energy balancing. Their technological capabilities could enhance grid reliability, stability, and efficiency.

We believe that they will delay their entry into the energy market, because of the current unattractiveness of the market. The implementation of the Ofgem price cap over the past year or so has compelled suppliers to sell energy at prices lower than their wholesale gas and electricity costs. This has resulted in most customers being charged the same rate, known as the price cap rate. However, wholesale prices are starting to decline, and as suppliers gain the ability to charge rates below the price cap, we can expect a resurgence in customer switching. Nevertheless, it is unlikely that this will attract many new entrants in the very near future.

When energy prices stabilize back and the dust has settled in the energy market, we will undoubtedly see the entry of new competitors into the market. So be prepared and have a strategy in place for when this happens.

We are convinced that when they do enter the market, this will bring about a lot of changes, which will only benefit the end-consumer.

Ferranti’s strategic partnership with Microsoft for over 25 years provides the right combination to ‘fly with the dragon’. Microsoft’s digital presence, innovative technologies, and strong market influence together with the Ferranti deep utility market knowledge and recognition is the key to success.

Microsoft’s business success is based on the success of their customers and partners, and it is committed to supporting the highly diverse partner ecosystem to help utility customer with their digital ambitions. This strategic choice of aligning Microsoft’s innovation scenarios and solutions to partners’ strengths such as the MECOMS 365 platform, in enabling and scaling industry innovation.

Mar Jorba

Talk the talk

Stay informed about current events and stay on top of the latest trends for energy suppliers, grid operators, heat-and-water providers.